Skill Tree #15 - May 07

We're so back (from Tokyo 🇯🇵)

Back from my short break, so I decided to do a longer newsletter this time to make up for it!

Making PVP games non-zero sum

Small victories during a game means players have positive experiences even if they lose the match in the end, increasing their satisfaction. Example: Getting a clutch play in CS:GO.

Marvel Snap designed for this. Players can increase the stakes by snapping, adding another cube (a form of in-game currency) to the reward pool. But the other player can strategically decide to retreat (the wording is important here), making him feel good even though he just lost the match! The framing of the whole outcome changes.

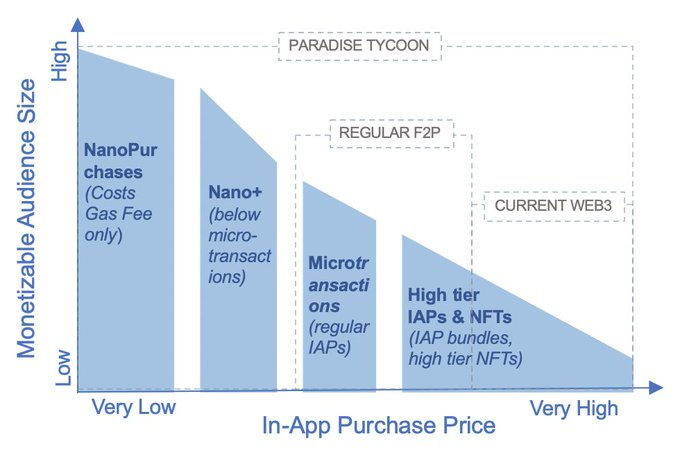

Web3 enables nano purchases, opening up new monetization models for game studios

In F2P games, only a tiny subset of players (~1.5%) spent money. This affects how games are designed - catering to whales with the rest of player often serving as the content for high-paying users.

Nano purchases, enabled by crypto payment rails, are affordable for larger audiences compared to traditional IAP. This also makes emerging markets more attractive for game studios.

Nano purchases might even impact gameplay by potentially reducing the power gap between player segments.

New token model: Reserve Utility Token

The Reserve Utility Token model adds a partial token backing to NFTs, capturing NFT demand in the token (value accrual).

When buying an NFT on the primary market, users automatically buy a fixed $ amount of the token with it which is used to back the NFT and creates a direct relationship between token demand and NFT demand. They can then later sell NFT + token backing, or burn the NFT to instantly unlock their tokens.

Benefits of the model include

predictable value accrual to the token (as NFT minting locks up supply)

immediate liquidity for NFTs through the redemption mechanism (burn NFT to instantly unlock tokens)

while the required fixed $ amount (instead of fixed token amount) reduces the risk of an unsustainably large token value accrual and rising NFT minting costs.

The model also comes with challenges. NFT liquidity gets fragmented as token price changes over time, which is why NFTs are backed by different amounts of tokens. Moreover, the model may suffer from boom and bust cycles as token supply gets locked up but can be released instantly in case of a panic.

Recommend reading the whole blog post for more insights

My thoughts: Happy to see new token proposals! Imo this model is most interesting for games that want to have a clear relationship between NFT demand & token demand and have large user bases. Their game economies need to support the Reserve Utility Token model through high-volume NFT markets where fragmentation is still manageable and a liquid token, as otherwise price manipulation may be possible and negatively impact users.

I like the redemption mechanism. Essentially gives users the option to get instant liquidity for a penalty. I also imagine it can help with supply-demand dynamics of NFTs. Holders are more likely to burn the NFT if there's little demand for it, thereby bringing supply closer to demand. Although I see this mechanic to be better suited for ERC-1155 than ERC-721. Therefore, the main use case are high-volume, low-value assets - basic game NFTs, not scarce assets. This also means that the token’s overall value capture depends on how much value is in these basic NFTs vs high-value NFTs of a game.

The model creates a direct relationship between NFT and token, providing strong assurances of value capture. On the other hand, the interconenctedness creates complexity, as exemplified by the fragmented markets and the need to have both liquid NFT and token markets, with the two influencing each other. The direct link of NFT and token also means forced exposure for users, who are subject to volatility in both NFT and token (although the NFT has a price ceiling).

From the Reserve Utility token model as a foundation, I expect new token designs to emerge which with different trade-offs. For example, I could see games utilize NFTs + token staking to drive token demand.

(some shower thoughts below)

Users buy NFT for 1$, buy & stake 1$ worth of TOKEN to get in-game benefits (workflow can be abstracted away). Then NFT & tokens get sold separately on the secondary market (no fragmentation).

Potential differences vs the Reserve Utility token model:

a) speculators could only bet on NFTs without buying the token, so there's less correlation than in the backing model. Overall impact is dependent on share of speculators within the market. At the same time, could give more design flexibility by giving some utility to the bare NFT and only limit additional utility to NFT+ token stake to segment players further

b) tokens more regularly hit and leave the market than in the backing model. Token supply is less locked-up. Users have no opportunity costs (burning NFT) to unlocking tokens. Could potentially introduce a cooldown to get both, but user can burn NFT to access tokens directly. it might enable better price discovery (larger volumes) but also lead to more short-term price swings as (lower) NFT attractiveness gets more directly reflected in token price. The cooldown can help here too

c) lower revenue for game studios if NFT marketplace fees > DEX fees

This newsletter is sponsored by Hiroba

How to use tokens and NFTs in different game genres

Fungible tokens (FTs) as in-game currency

Biggest challenge: inflation. Potential solution: isolating tokens to sub-systems of the game

Semi-fungible tokens (SFTs)

For resources and crafting materials

Non-fungible tokens (NFTs)

For rare items and collectibles

Example: BR/extraction games

FTs as battle pass rewards

Ties token distribution to engaged and spending players of the premium battle pass

Allows them to recoup part of the costs

SFTs for consumables and limited-use power-ups

NFTs for rare skins and exclusive content

The case for on-chain games

On-chain games are autonomous worlds as game state and game logic are openly accessible on the blockchain, can be forked and communities can govern the ecoystem based on open principles.

Autonomous worlds unlock two new major shifts

Uncensorable ownership & permanence results in actions having real economic stakes, driving significance and immersion

Players become co-creators as they can add to the game experience permissionlessly, accessing all game state and logic. Better incentive alignment between game and modders as more extensions add value to original assets. Provides a basis for interoperability.

“With on-chain games, every content addition results in a multi-factor expansion of playable content. Economic players and resource accumulators have new financial opportunities they can exploit from the disequilibrium introduced by new content.”

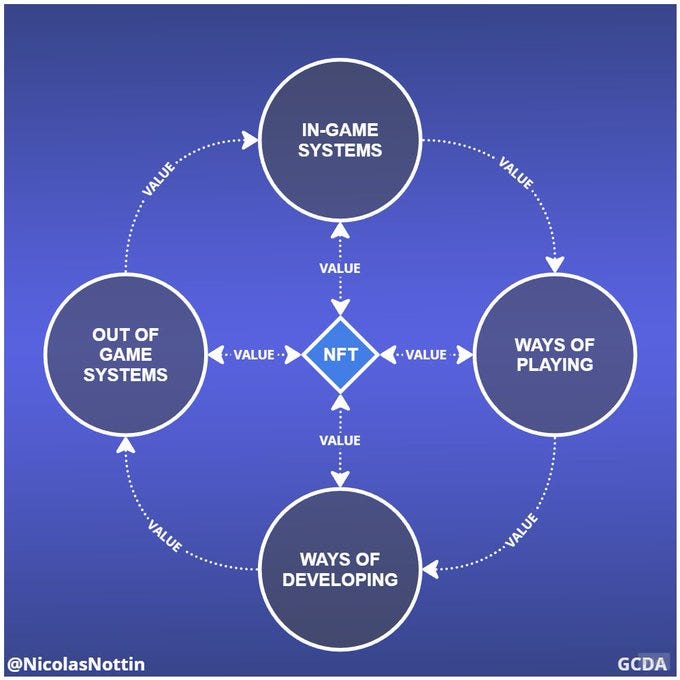

The player journey, the NFT journey, and NFT utility

Step 1: Think about the player personas, their journey and how they can add value

Step 2: How are the personas connected with each other

Step 3: How are NFTs connected to the personas

“Each persona, each system, each motivation, and each social dynamic has its unique way of adding value to an NFT“

My thoughts: An important aspect of the NFT journey is that it starts before the game is live, with the NFT mint (or even before). For game studios this means that liveops in the form of NFTops way become a thing way earlier than in traditional game development.

New trend with staying power? Content creators building games

Streamers Timthetatman, CouRageJD, Ninja, Nickmercs, and SypherPK announced last week that they’re teaming up for Project V, a battle royale game built on Fortnite Creative by SuperJoy Studios. This is the latest example of an ongoing trend: Dr DisRespect is working on Deadrop, Alexandra Botez teased a chess-related video game, Shroud is building a survival game.

Creator-driven games come with strong benefits

Existing target group (distribution) and marketing at 0 costs

Flywheel effect between game and content around it helps to activate and retain players

Stronger connection between creator and fans. Emotional (parasocial) relationship can also drive player spending. Nexus found that players whointeract with a creator program have nearly 2x the LTV of the average paying player

Additional (scalable) revenue stream for creators

My thoughts: As games are battling for attention, we have seen in the mobile market how studios often rely on strong IP to make their game stand out and reduce UA costs. Creator IPs are the next logical step in this development imo. UGC platforms like Fortnite or Roblox play a key part here as they reduce development costs and cycles, while their integrated tools enable fans to build on top of their idol’s games.

Also check out Alex’ take https://twitter.com/awettermann/status/1654524202781900801

WolvesDAO discussion: NFT royalties in Gaming. How important are they? How to solve it?

Royalties are an essential piece to make web3 gaming work There seems to be overall agreement that royalties play a vital role as part of a game's NFT business model and as ONE source of revenue

Enabling peer-to-peer trading affects the value studios can capture through primary sales. Earning a take rate on secondary sales becomes key.

With interoperability (even at a limited scale), external developers may drive demand for a game's NFTs. Royalties open up a new revenue stream here.

Taxes, which royalties are a subset of, also have shown to be an effective economic sink

Royalty enforcement

The Wolves named multiple options, including

Give utility only to holders who paid a royalty, for example using LimitBreak’s staking system

Enforce royalties directly on-chain

Games run their own marketplaces to enforce royalties

Another point was that with players entering the market, rather than traders, games have an opportunity to monetize this new, less price sensitive target group

What if we fail at enforcing royalties?

Without strong monetization opportunities, business models will favor primary mints, leaving assets with a fast value decline. That's not much different from web2, making NFTs nothing more than a marketing catchphrase.

So it's also in the interest of players to have a working royalty system, as game studios need to be profitable to create games. Players may even directly benefit from royalties.

Games are leaning more heavily into UGC now, with Fortnite being the latest example. Players turn into creators and may profit from royalties themselves.

Recommended listen: Doubl3Tap

20min podcasts every Wednesday @ 11:30am EST by @jacl_e9 & @awettermann

1 topic per month, divided into smaller pieces for weekly bite-sized Twitter Spaces with guests.

Latest episode:

https://twitter.com/JACL_e9/status/1653782850502635525

Also check out my podcast with @jacl_e9 & @awettermann about TreasureDAO

esports games come natural

esports games cannot be designed for, they need to be inspired first.

“take awesome games and take the best winning game mechanics and push them into new genre and explore different game loops and objectives that have nothing to do what is popular now.“

Strong esports titles came from mods.

The potential impact of web3 on gaming

Business model disruption (e.g. nano purchases, higher-value IAPs) which allows for new types of games to be made

Potential value alignment between developers and players where game studios focus on maximizing value of virtual goods (and capturing a part of it) vs selling IAPs to whales

New ways to interact with a game: Play > Spectate & discuss > Discover, Analyze, Trade, Contribute