Improving Point Airdrops

Increasing retention by moving from singleplayer to multiplayer

Point airdrops have been making headlines, positively and negatively. As always, the perceived fairness of such systems depends on how teams utilize them. I still believe point airdrops have distinct advantages over previous models such as liquidity mining or one-time airdrops. In an article last year, I described so-called “airdrops in chunks”. Now, after seeing them in action in the form of point airdrops, I’d like to share some learnings and introduce a new idea - vesting points into tokens based on protocol milestones.

Gib Points - An Analysis of Point Farming Mechanics

Instead of receiving a token airdrop, users get airdropped points. Often, this is done in seasons. In that case, point airdrops can be seen as a versatile replacement for liquidity mining, fostering flexibility and a broader design space.

Advantages

Incentives before token launch

Setting the right incentives at the right times is crucial for projects. However, there might be a mismatch between when incentives are needed and when a token is ready to be launched. Token launches require the product and the token design to be developed enough to create demand.

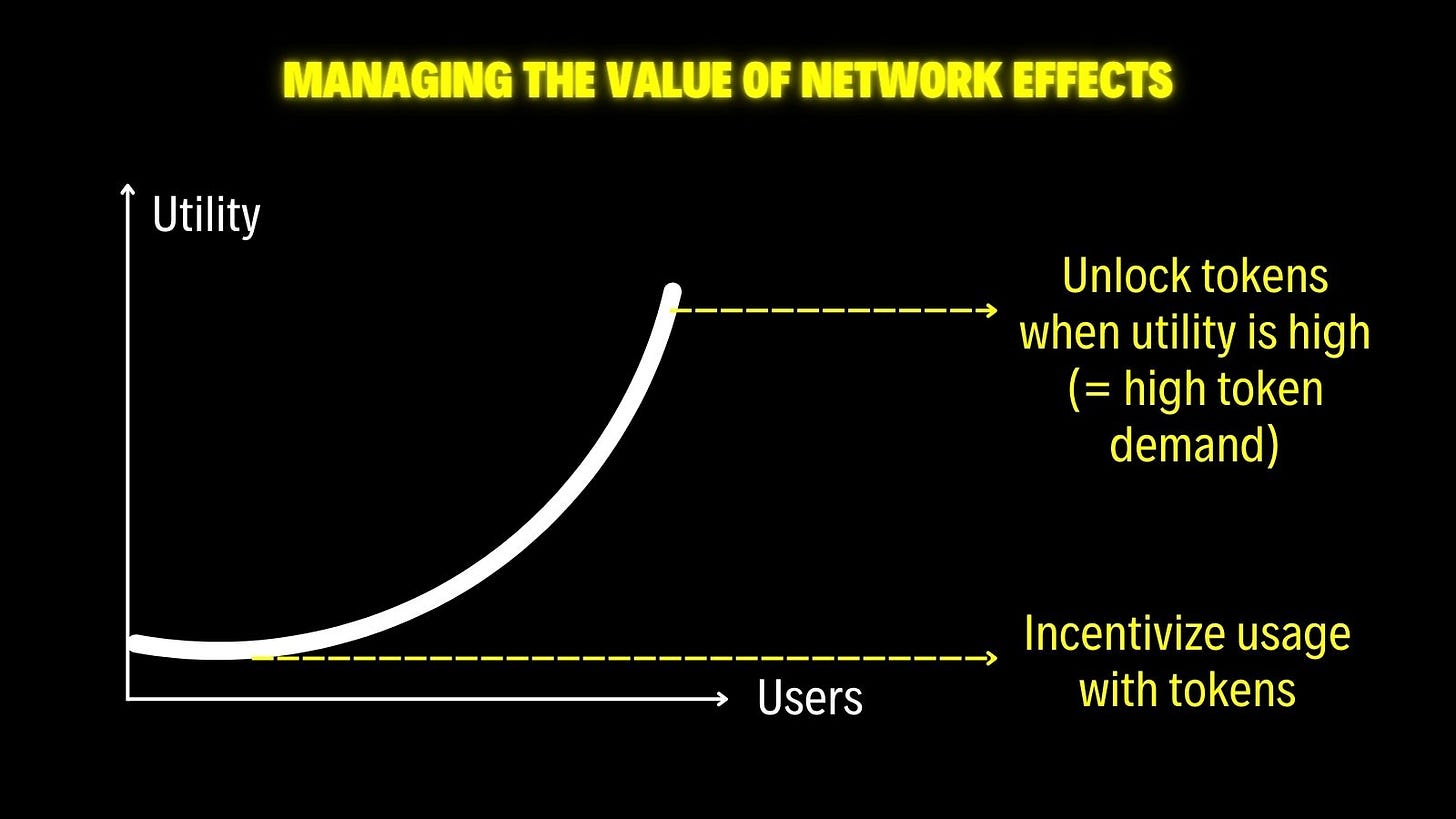

Point airdrops fix this dilemma. Teams can incentivize usage while still building out the product and tokenomics. As a result, tokens can be “emitted” as points without needing to have token demand ready at the same time. Points can create network effects while the token only becomes tradable at a later point once the long-term impact is visible, creating demand.

From my previous article ‘A Framework for Airdrops’

Bootstrapping networks (e.g. liquidity) is often the first bottleneck new services face. For example, the AirBnB founders went around NYC personally to make apartment owners sign up. Crypto networks provide us with a new way of incentivizing the supply side — tokens.

When a product benefits from network effects, it’s sensible to let early users take part in the network value they helped create. Normally, early adopters take on more risk but extract the same value from the network as latecomers. For example, the first buyers of a telephone made an expensive investment without much value at first (not many people to call). Over time, costs to acquire a telephone decreased and new users came in. At some point, everyone owned a telephone. People now had an efficient form of communication, everyone in a group could call each other. Everyone has the same value, while early adopters took the initial step and therefore the bigger risk. Tokens help to re-distribute the network value on a risk-adjusted basis. An issue arises when the first users only help to bootstrap the network for monetary gains and can easily leave after extracting value, thereby destroying the built-up network value.

Retroactive rewards

Tokens are airdropped based on the points users accumulated. This provides teams with more flexibility than distributing tokens in the form of liquidity mining rewards.

If not communicated beforehand, teams can retroactively determine the amount of tokens to be distributed depending on the performance of the points campaign, ensuring good ROI. Of course, user perception has to be kept in mind as well. The amount of rewards has to feel fair.

The rate at which different user actions are rewarded with points, aka how actions are weighted against each other, still needs to be decided beforehand. But, the total amount of tokens distributed can be chosen later, taking into consideration real-world data. Having no points and just doing retroactive token airdrops from time to time would provide more flexibility. However, points keep people engaged. They’re the carrot on the stick that ensures the upcoming airdrop stays top of mind.

Speculation drives engagement

Speculation on the size of the inevitable token distribution can fuel attention. Additional speculative mechanics like awarding loot boxes with mysterious amounts of tokens further boost engagement. It’s an attention economy after all.

Seasons > continuous rewards

Another advantage of running point airdrop seasons, for example compared to continuous liquidity mining programs, is that changes can be made and communicated more easily. For instance, the amount of tokens distributed can be adjusted, points received for different actions can be rebalanced, or rewarded actions can be changed completely to switch up the meta, keep things fresh, and introduce new features.

Tradeoffs

The flexibility point systems offer teams on the flipside mean uncertainty for users. Instead of receiving tokens that can be turned into money immediately, users receive points and compete for an allocation of a token airdrop, often with an unknown date and amount.

This reduces exploitability by mercenary farmers and can help acquire the right users via self-selection. On the other hand, it becomes unattractive to users.

In the end, the various token emission logics only distribute risks (stemming from factors such as network effects not materializing or pressure from competing protocols) differently across the protocol and its users.

While not a single predictor of success for token reward campaigns, we can generally assume that less attractive rewards mean less attention. Especially in the bull market, direct token rewards may capture the narrative again, taking attention away from teams utilizing more balanced approaches to emissions such as point systems or OLM. Therefore, I expect point campaigns to be most effective for projects with a strong brand. On the other hand, less attention may not be the worst as long as it comes from the right audience segment.

Challenges

A challenge remaining is long-term retention and alignment. What comes after an airdrop? The next airdrop? Moreover, point farming so far has been a singleplayer effort. Aside from usage, we also want to incentivize multiplayer activities like word-of-mouth and social coordination in governance. We want to reward users with tokens so they become stakeholders who care about the protocol’s health.

Creating Multiple Incentive Layers through Milestone-based Point-to-Token Conversion

Essentially, milestone-based vesting means that points users accumulated are not converted into tokens at a set date. Instead, only a part of the tokens becomes available at day 0, while the rest is unlocked based on predetermined milestones of the protocol. These milestones can, for example, be TVL, trading volume, amount of users, or fees generated.

Advantages

Stronger incentives

The multi-layered incentive mechanics provide strong retention potential throughout the reward lifecycle.

In Phase 1, users farm points as usual.

In Phase 2, a share of their points is immediately converted into tokens for instant gratification to anchor the point farming to positive feelings and make it something that people want to repeat. The rest of their points are unlocked based on protocol-wide milestones. That establishes two layers of incentives: Users not only keep using the platform to accrue more points (in the next season) but also to unlock their existing points. The latter enhances users’ motivation to reach the milestones as otherwise their previous time/capital invested to farm points would become worthless (sunk cost fallacy). Points are used to slowly build up users’ investment into the ecosystem to create “skin in the game” while milestones provide clear goals and rewards for continuous investment.

In Phase 3, the protocol can slowly fade out incentives by successively reducing point rewards to zero until only milestone-based unlocks remain.

Align stakeholders with protocol success

As mentioned previously, point farming is a lonely effort. Users farm airdrops for themselves for speculative purposes, hoping that others won’t dilute their yield.

The described system here makes use of this. Speculation drives people to farm points in their “singleplayer mission” but a large part of points only gets converted into tradeable tokens when protocol-wide milestones are reached (“multiplayer mission”). Users are therefore incentivized to care about the “multiplayer mission” to reap the full rewards of their “singleplayer mission” (sunk cost). By doing so, it might be possible to turn some of them from egoist farmers into aligned contributors who care about the health of the protocol (determined by milestones), participate in governance, and support marketing to drive user adoption to reach milestones.

Coming back to our discussion about network effects (Figure 1), milestone-based point vesting allows us to set KPIs that measure the results of network effects. Like before, early adopters are rewarded for helping to create the network effects and for taking risks while doing so but now only receive tokens after the network effects have measurably materialized which, given sound token utility, should lead to demand for the token. This hopefully helps to approach more demand-based emissions while still using incentives to bootstrap the network before demand can build up. As token supply better matches the demand in the market, death spirals become less likely. These vicious cycles happen when farmers dump their rewards, devaluing future incentives in the eyes of users. As farming becomes unattractive, users leave before network effects can be established.

In comparison to time-based airdrops to point holders, milestone-based vesting shifts execution risk partly to stakeholders. This can feel unfair as stakeholders may only have limited control over the product as opposed to the team. Of course, that depends on how far governance and product development have been decentralized. In general, it’s recommended to only have a part of tokens vested based on milestones. A mix could look something like this:

⅓ unlocked without milestones (can be vested over time)

⅔ unlocked with milestones

The milestone-based unlocks could also feature an alternative path based on direct singleplayer contributions to the multiplayer mission. For example, users get awarded points for LPing, as TVL is needed to bring in traders. Points are converted into tokens when traders come in that use the liquidity (and pay fees to the protocol) based on predetermined milestones for trading volume. Point holders can also have personal contribution goals like directly referring traders to the platform which a) helps reach overarching milestones, unlocking tokens for everyone, and b) can be rewarded with special unlocks for the referrers. While that can only be done for activities that are easily trackable, it provides users with more agency and directly incentivizes contributions.

Clear calculation & communications

With milestone-based vesting, teams are clearly communicating goals to their stakeholders upfront for when tokens will be unlocked. On the flip side, they lose flexibility.

Token amounts and milestones can be designed in a way that token emissions are correlated with fees earned, providing teams with clarity.

New shiny thing

Hasn’t been done before = captures attention. As projects are competing for mindshare with token incentives, providing something new can help to stick out from the rest. Additionally, teams can provide a large airdrop allocation, aka a shinier prize pool, as tokens only unlock slowly over time based on milestones whose successful reach leads to token demand in the best case.

Tradeoffs

Similar tradeoffs apply here as discussed for traditional point reward systems. But, milestone-based vesting brings more clarity for users. On the other hand, it provides teams with less flexibility.

Future improvements

This article aimed to explain the pros and cons of point systems and introduce an extension to the mechanic, so-called milestone-based vesting. The goal is to create stronger, more long-term incentives for users to increase retention, better alignment of stakeholders with the protocol, and more clarity for point farmers.

I’d be happy to see more discussions around the topic. Interesting points for debate include:

After reaching a milestone, does the whole batch of tokens unlock at once or over time?

Should there be a deadline for milestones after which points can no longer be converted into tokens?

How to further gamify unlocks? For example, by introducing teams that compete for unlocks